Hedging Using Options

30 Dec 2020

Hedging is a crucial part of my strategy, however I’ve usually conducted hedging using future deriviative contracts which involve more exposure and are more risky. Other approaches I have done are vanilla selling to fiat or another asset class that is safer.

I decided to look into Options and exploring what they are all about, after seeing a lot of Redditers on r/WSB get rich on Robinhood from the “V Shaped Recovery”.

The notes below is what I took down when watching the video above about how to hedge using options since it is a newer topic to me which I want to implement in my own strategy.

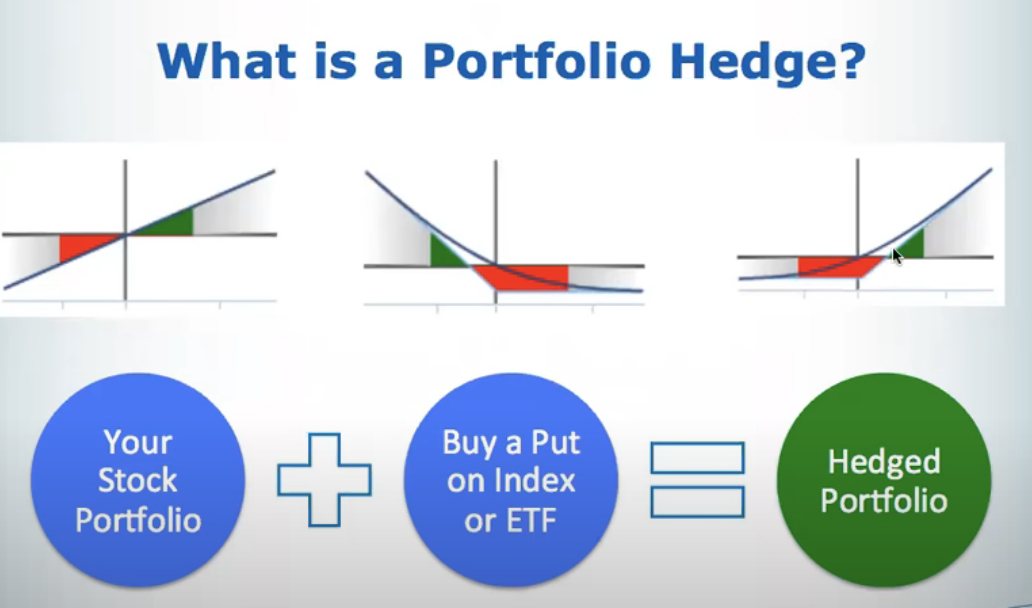

Hedging is generally done when you feel the market is about to correct at some point in the near future. Options is a good tool to hedge because it is like buying insurance if you decide not to sell your stocks.

Options helps secure your fiat value of your portfolio in case of a correction. Say you own 10-20 different companies, rather than hedging each company individually, you would instead buy a put contract on an index like SPX, XKO or an ETF that encapsulates your companies.

P&L Chart is linear in a spot portfolio. Options change that to a slight curve higher in terms of loss, however there is unlimited theoretical gain.

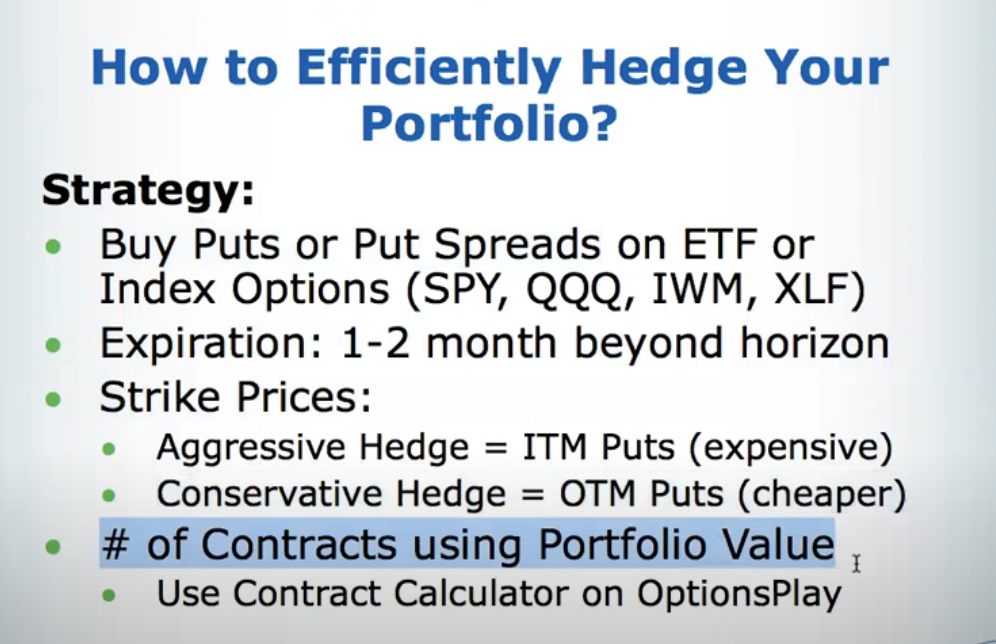

Options are expensive, and generally used if corrections of greater than 3-5% are expected.

A perfect hedge would be selling everything for spot, options provide you a partial hedge as you are buying an instrument that will expire worthless if the market does not correct so you lose that $ amount.

- Aggressive Hedge - ITM (In the money) Puts (Expensive)

- Conservative Hedge - OTM (Out the money) Puts (Cheaper)

- Index Options - Preferred Tax Treatment (60/40 Income Tax/Capital Gains Tax)

- Use Instrument based on your portfolio:

- Broad Portfolio - SPX, SPY, IWM

- Tech Portfolio - NDX, QQQ, XLK

- Bond Portfolio - BND, TLT, LQD

Conservative hedges cost 1.5% ~

Aggressive hedges cost 3%~

The video does not recommend buying puts to hedge more than 3-4 months out so timing is extremely key in this sort of strategy. I myself do not time the markets on such a small scale after quitting day trading, so it is quite a new take on investing with the twist of options.

I personally prefer Conservative OTM hedges based on the cheapness vs ITM and the fact that they can become ITM options which would revalue them higher allowing for a quick flip since it is better to cash the options rather than wait for them to settle.

To wrap the blog, I would not base my decisions on greed or luck like the Redditors around at r/WSB, but there are a lot of calculations required, and options can result in pretty substanstial losses if not careful. The tale of Alex Kearns serves as a cautionary warning for all of us. I personally look forward to exploring Options further when time permits.